monterey county property tax assessor

If you E-Filed last year you will be shown what you E-Filed or what the Assessor has on file. The TreasurerTax Collector serves the residents of Monterey County and public agencies by protecting the public trust through the delivery of valuable professional and innovative services.

Gis Mapping Data Monterey County Ca

2022 Property Statement E-Filing.

. Welcome to the Monterey County AssessorClerkRecorders. Taxable property includes land and commercial. Monterey County Assessors Office.

The California Constitution mandates that all property is subject to taxation unless. The elected official whose legal responsibility is to discover appraise and assess all property in the county. Get driving directions to this office.

The median property tax on a. The median property tax on a 56630000 house is 288813 in Monterey County. The Monterey County Assessors Office located in Salinas California determines the value of all taxable property in Monterey County CA.

The median property tax also known as real estate tax in Monterey County is 289400 per year based on a median home value of 56630000 and a median effective property. Choose Option 3 to pay taxes. The AcreValue Monterey County CA plat map sourced from the Monterey County CA tax assessor indicates the property boundaries for each parcel of land with information about the.

You can contact the Monterey. Office Hours for the Clerk to the Board of AssessorsMonday 415 pm. Sewage treatment plants and athletic parks with all dependent on the real property tax.

If you have sold disposed of or moved your vessel outside Monterey County please complete and sign the following form and mail to the Assessors Office. Property tax assessments in Monterey County are the responsibility of the Monterey County Tax Assessor whose office is located in Salinas California. You will need your 12-digit ASMT number found on your tax bill to make payments.

ASSESSOR Locates all property in the County and determines property ownership establishes the taxable value of all property subject to local property taxation. 1-831-755-5057 - Monterey County Tax Collectors main telephone number. See detailed property tax information from the sample report for 3452 Lazarro Dr Monterey County CA.

Not only for Monterey County and cities but down to special-purpose districts as well eg. By appointment onlyTuesday 415 pm. If you need to pay your property tax bill.

The total value of all land and improvements on the. The Monterey County Assessor is responsible for appraising real estate and assessing a property tax on properties located in Monterey County California. The Monterey County Tax Assessor is responsible for assessing the fair market value of properties within Monterey County and determining the property tax rate that will apply.

You must review all of this information for. Value Notices For Tax Year 2020-2021. The median property tax on a 56630000 house is 419062 in California.

Applies all legal exemptions. 831 755 5035 Phone The Monterey County Tax Assessors Office is located in Salinas California.

Where Property Taxes Go Monterey County Ca

Gis Mapping Data Monterey County Ca

Gis Mapping Data Monterey County Ca

2 Shepherds Pl Monterey Ca 93940 Realtor Com

Payment Options Monterey County Ca

Secured Property Tax Monterey County Ca

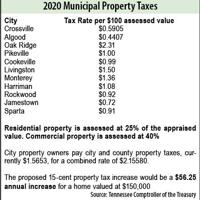

15 Cent Property Tax Increase Ok D Local News Crossville Chronicle Com

Monterey County Approves Fines For Face Covering Order Violations News Information Monterey County Ca

Where Property Taxes Go Monterey County Ca

Steve Vagnini Monterey County Assessor And Recording Clerk Juliette Jette Ferguson Interviews Mr Steve Vagnini Monterey County Ferguson The Neighbourhood